Health Insurance Quotes

No matter who you are and what you do, health insurance should be at a priority in your portfolio. Health Insurance is an asset that should be purchased when you are in fit and perfect. Many don’t realize this, delaying buying health insurance.

Health insurance is like an asset for those who have purchased on time. When health insurance comes into use, the proposer thanks himself for being smart.

When navigating health insurance options, consider the benefits of obtaining quotes through health professionals rather than solely relying on online portals. Professionals can provide tailored advice and clarify the complexities of policies, ensuring you select the best coverage for your needs.

Types of health insurance policies available:

- Family Floater Health Policy: This policy covers the entire family under a single sum insured, making it a cost-effective option for families. It ensures that each member has access to essential healthcare without separate premiums for each individual.

- Personal Accident Care: Personal accident policies offer financial support in case of accidental injuries or death. They provide compensation for medical expenses and can help with income loss during recovery.

- Diabetic Care: With the rise of diabetes, specialized diabetic care policies cater to individuals with this condition. These plans often include regular check-ups, consultations, and coverage for necessary medications.

- Cardiac Care: Given the increasing prevalence of heart-related issues, cardiac care plans focus on coverage for heart diseases, including surgery, hospitalization, and ongoing treatment.

- Senior Citizen Health Policy: Tailored for older adults, these policies address the specific health risks and needs of senior citizens. They typically offer coverage for pre-existing conditions, regular health check-ups, and other age-related concerns.

- Travel Insurance: Essential for travelers, this insurance protects against medical emergencies, trip cancellations, and loss of belongings while abroad. It ensures peace of mind when exploring new places.

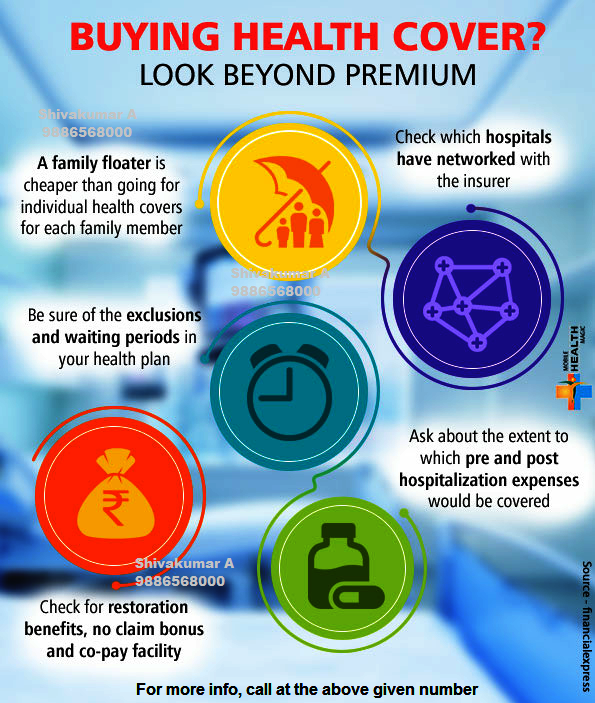

Choosing the Best Policy:

- Best Claim Settlement: Look for insurers known for their efficient claim settlement processes. Research customer reviews and industry ratings to find a provider that handles claims promptly and fairly.

While online portals provide quick quotes, consulting health professionals can lead to more informed choices tailored to your specific needs. Consider your family’s health, age, and lifestyle when selecting a policy for optimal coverage.