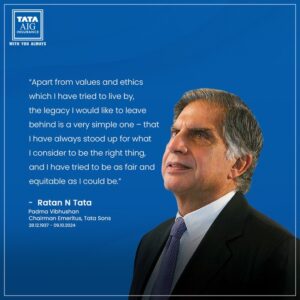

TATA AIG Health Insurance

TATA AIG Health Insurance India is indeed a part of the Tata Group, specifically through a joint venture with the American International Group (AIG). Established to provide comprehensive health insurance solutions, Tata AIG Health Insurance offers a range of policies designed to cover individual and family healthcare needs. It combines Tata’s reputation for ethical business with AIG’s global insurance expertise, focusing on customer-centric services and innovative health plans in India. one of India’s largest and most respected conglomerates, places a strong emphasis on ethics and corporate social responsibility.

TATA AIG Health Insurance India offers a variety of health insurance plans designed to cater to different healthcare needs. Here are some key features and options available under their plans:

Comprehensive health coverage

TATA AIG Health Insurance provides extensive coverage that includes hospitalization expenses, pre- and post-hospitalization costs, daycare treatments, and ambulance charges. This ensures you are protected against a wide range of medical expenses.

Cashless Hospitalization

They have a large network of hospitals across India where you can avail cashless treatment. This means you don’t have to worry about upfront payments during emergencies, as the insurer directly settles the bills with the hospital.