Table of Contents

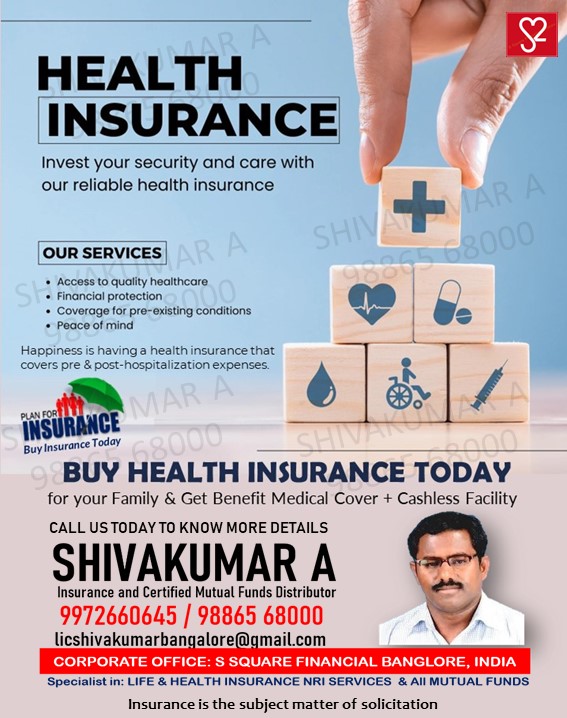

ToggleBuy Health Insurance with all-in-one benefits

Know your Insurance Advisor first

In an increasingly digital world, the convenience of purchasing insurance online can be tempting. However, potential buyers should exercise caution, particularly when it comes to health insurance. The online risk is not limited to scammers and their fraudulent acts.

The Risks of Buying Insurance Online and sharing OTPs

Online insurance fraud involving OTP (one-time password) scams has become increasingly prevalent. In these scams, fraudsters impersonate legitimate insurance companies, contacting victims via email or phone to solicit personal information. They often claim that a verification step requires an OTP, which they then use to access the victim’s accounts. Once they have this information, they can steal funds or commit identity theft. Victims may be led to believe they are securing their policies, but in reality, they are giving away sensitive data. Awareness and vigilance are crucial; consumers should verify any communication with their insurance provider directly before responding. This is especially critical when considering comprehensive family health insurance that covers not just immediate family members but also parents, in-laws, and senior citizens.

Understanding OTP Fraud and Online Scams

Additionally, many fraudulent online websites may present themselves as legitimate insurance providers, offering attractive policies at unrealistic prices. Without proper due diligence, buyers risk falling into traps that could lead to financial loss and compromised personal information.

Buy Health Insurance with all-in-one benefits 9886568000

Buy Health Insurance with all-in-one benefits 9886568000

The Importance of Comprehensive Family Coverage

When looking for health insurance, especially for families that include parents and in-laws, opting for a comprehensive all-in-one health insurance plan is essential. These policies provide a broad range of coverage options, accommodating the diverse healthcare needs of all family members, including senior citizens who often require specialized care.

- Extensive Coverage: All-in-one plans can cover a variety of medical expenses, from hospitalization to outpatient treatments and preventive care. This breadth of coverage ensures that every family member, regardless of age or health condition, is protected.

- Customizable Plans: Unlike many online offerings that come with fixed terms, reputable insurance providers often allow for customization. This means you can tailor your policy to include necessary riders for specific needs, such as maternity benefits or critical illness coverage.

- Ease of Claim Processing: Well-established insurers provide a smoother claims process, often featuring a network of hospitals that accept cashless treatments. This is crucial for senior citizens who may need immediate medical attention.

Why All-in-One Plans Outshine Corporate Benefits

While many corporate employers offer health insurance benefits to their employees, these plans can be limited in scope. Here’s how all-in-one family health insurance can offer superior benefits:

- Comprehensive Family Coverage: Corporate plans often only cover the employee and their spouse. In contrast, all-in-one health insurance can extend to parents and in-laws, which is particularly beneficial for families where multiple generations live together.

- Flexibility and Portability: Many times, corporate health insurance is tied to employment, meaning that if an employee changes jobs, they could lose their coverage. An all-in-one plan offers portability, ensuring that families maintain their insurance regardless of job changes.

- Tailored Benefits for Seniors: Many all-in-one policies include specific benefits for senior citizens, such as coverage for pre-existing conditions and daycare procedures that cater to their unique healthcare needs.

Choosing the Right Insurance Provider

Given the risks associated with online purchases, it’s vital to choose your insurance provider wisely. Here are some steps to ensure you’re making a sound decision:

- Research Reputable Companies: Look for established insurers with a strong reputation in the market. Check their customer reviews and claim settlement ratios to gauge reliability.

- Consult an Insurance Advisor: An experienced insurance advisor can guide you through the complexities of health insurance and help you avoid scams. They can recommend plans that best suit your family’s needs and ensure you’re getting legitimate coverage.

- Read the Fine Print: Always review the policy documents thoroughly before making any commitments. Understanding the terms, conditions, and exclusions will help prevent unexpected surprises later.

- Avoid Unverified Websites: Stick to known, reputable insurance websites or consult with established brokers. Avoid clicking on links from unsolicited emails or messages that promise incredible deals.