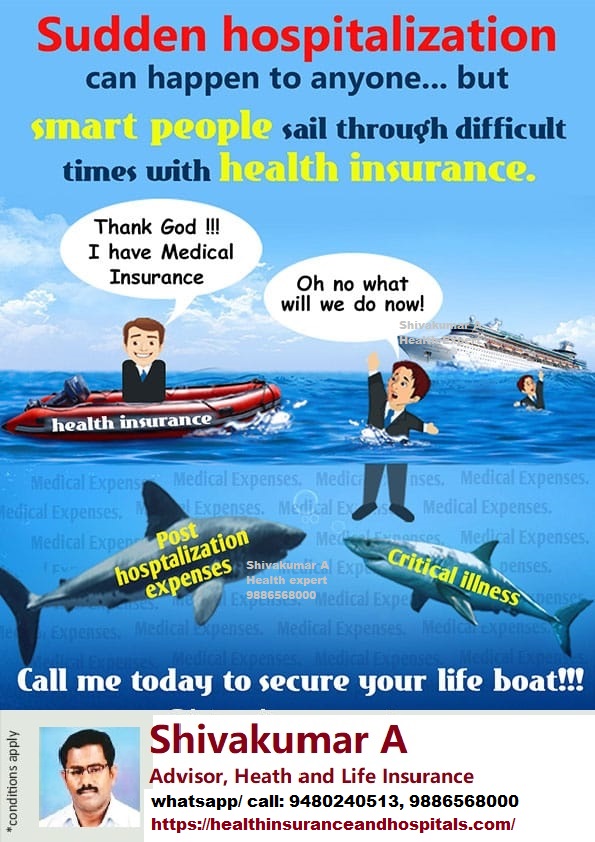

Buy the Best Health Insurance

Health is Wealth: The Importance of Investing in Health Insurance

The age-old adage “health is wealth” rings truer than ever in today’s fast-paced world. Our health underpins every aspect of our lives—our productivity, our happiness, and ultimately, our financial stability. Investing in health insurance is not just a financial decision; it’s a commitment to safeguarding your well-being and that of your loved ones.

One of the best times to purchase health insurance is when you are fit and healthy. Many people wait until they face health issues or become older to think about health coverage. However, securing health insurance early can significantly lower your premiums and expand your coverage options. When you’re in good health, insurance companies view you as a lower risk, which can translate into better rates and more favorable terms.

One popular option for comprehensive coverage is a 1 crore health plan. This type of plan offers a substantial sum assured, which means that in the event of a medical emergency, you can access a large amount of money to cover hospital bills, surgeries, and other health-related expenses. With healthcare costs rising dramatically, having a robust policy can provide peace of mind and financial security. It ensures that you are well-prepared for unexpected health issues without depleting your savings.

Family floater health plans are another excellent choice for those who want to cover their entire family under one policy. These plans allow you to pool coverage for multiple family members, often at a more economical rate than individual policies. A family floater plan provides the flexibility of shared coverage, meaning the total sum assured can be utilized by any member of the family. This is particularly beneficial as it helps manage costs while ensuring that everyone has access to necessary healthcare services.

Moreover, relying solely on corporate health plans can be a risky proposition. While these plans often provide a good level of coverage, they come with limitations. Corporate health plans may not cover pre-existing conditions, may have a limited network of hospitals, and often cease to be effective if you leave your job. Job changes are common, and with them comes uncertainty about your health coverage. By investing in your own health insurance policy, you take control of your health care needs. You can choose the coverage that best fits your family’s requirements without being tied to your employer’s offerings.

Additionally, private health insurance gives you the flexibility to select the hospitals and doctors of your choice. Many corporate plans restrict your access to specific hospitals, which may not always be convenient or provide the best care. With a personal health insurance policy, you can select from a wider range of providers, ensuring that you receive the quality of care you deserve.

It’s also essential to consider the rising costs of medical treatments. With advancements in medical technology and increasing healthcare expenses, what might seem like adequate coverage today can quickly become insufficient in the future. A health insurance of Rs 1 crore can act as a safety net, ensuring you can afford high-quality care without financial strain.

The magic mantra of “health is wealth” underscores the necessity of investing in health insurance while you’re fit and healthy. By opting for a 1 crore health plan or a family floater policy, you not only protect yourself but also secure your family’s future. Don’t leave your health to chance or rely solely on corporate health plans that may not meet your needs. Take proactive steps today to ensure that you have the right health coverage. Your health—and your wealth—depend on it. Investing in health insurance is one of the smartest financial decisions you can make, providing you with peace of mind and security for years to come.